Gap Fill Theory

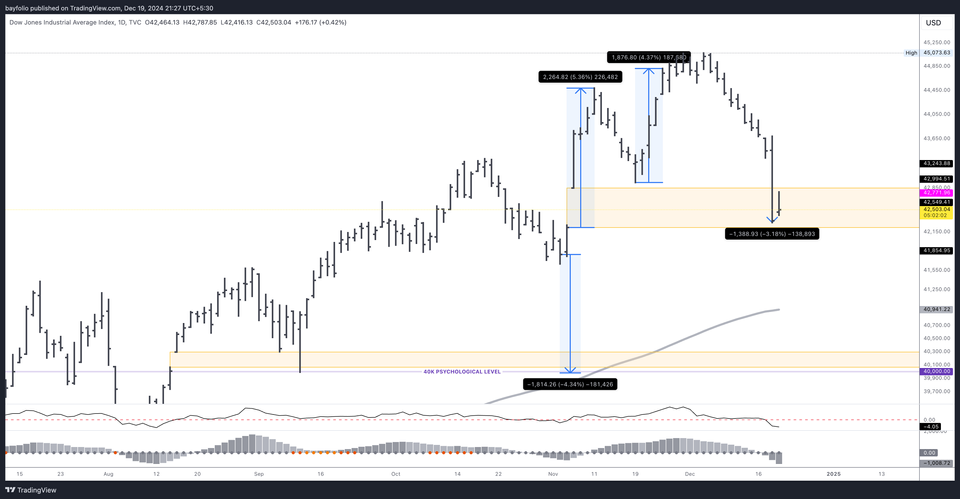

Over time, you learn to understand patterns. One of the most unique trends that I see is that when a gap up or gap down takes place — there is usually a reversal to fill that gap.

We saw this recently, just after the US elections and Trumps win — markets shot up, formed a gap up to be filled, and then after about a month, it filled the same.

If you have a closer look at the charge, you can also see previous gaps being filled. But this isn’t always the case.

If we go by this theory, which has an uncanny habit of coming true — then we might be in for some really bad downside (say 25%+) from where we are on the Nifty. See the zone in red below!

Scary. I know, could it happen? Anything can. Will it happen? Maybe not.

These gaps happen because of faulty price discovery. Something that needs to be addressed separately.

Member discussion